Contents

This means that if you put a Fibonacci retracement tool at A and B, then C should be between 0.382 and 0.786. Forex trading is challenging and can present adverse conditions, but it also offers traders access to a large, liquid market with opportunities for gains. Bitcoin , Ethereum , Litecoin , Bitcoin Cash and Ripple are leading cryptocurrency products. Once again, Fibonacci tools may be used to determine when the B-C retracement and C-D legs are complete.

- The stock gapped up the following morning to the $3,730 level.

- It looks just like a hammer with a mallet on top and a handle beneath.

- A bearish ABCD pattern appeared in the daily chart of gold from mid-July to mid-October of 2015.

- Since their appearance in 1935, many patterns have undergone some refinement.

The https://forex-trend.net/ pattern is a price action chart pattern that is most often used in intraday trading in the stock market. It can, however, be applied in other financial markets, such as futures, options and forex markets. It also works on a longer time frame if sufficient historical data is available. The ABCD is a market reversal pattern, signaling trend change, either from an uptrend to a downtrend or from a downtrend to an uptrend. This harmonic pattern that helps traders predict when the price of a stock is about to change direction. The pattern can be used to predict either a bullish or bearish reversal depending on the orientation.

To draw it correctly, wait for the top or bottom to form on the B to C pullback, then you can attach this line to the first line you draw from the high of A to the low of B. Lastly, you'll start your third and final trendline from the high of C to the low of D. This is when the price movement comes close or breaks the risk level you set. SMART Signals scan the markets for opportunities so you don’t have to.

Your Exit Strategy

In other words, if the https://topforexnews.org/ is trending upward on the AB leg, some traders will anticipate the BCD portion of the move by going long and buying the breakout. The abcd pattern in trading is an intraday chart pattern that reflects the natural movement of the market. It consists of an initial leg up or leg down followed by a short consolidation and then another leg up or down in the direction of the original move.

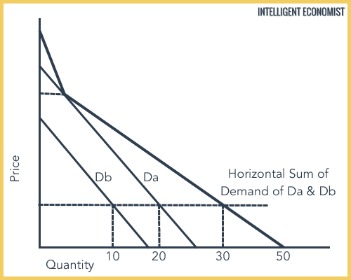

It reflects the strength of a stock and also provides an indication of the quality of a price trend and the liquidity of the stock. For both versions, the lines AB and CD are called the legs while BC is known as the retracement or correction. When shares make a new high then you want to look for resistance for a possible short entry. In this pattern, CD is 127.2% or 161.8% longer than AB instead of BC.

The ABCD pattern indicates what the risk is and follows a clear pattern and should therefore be used as a guide on when to sell, either to make a profit or cut losses. This trading pattern has been around for a very long time and is thus well-tested. Of course, there will be times when an exception to the pattern proves the rule, but to avoid heavy losses, it is best to adhere to it.

So how do I find an ABCD pattern?

The ABCD points create three separate legs which combine to form chart patterns. Each of the four points represent a significant high or low in terms of price on the chart. HowToTrade.com helps traders of all levels learn how to trade the financial markets. As you can see, much like the bullish ABCD pattern, the bullish AB line is 61.8% of the AC line, and the CD leg is 127.2% of the BD leg.

Before you implement the strategy, you should familiarise yourself with resources on how ABCD patterns work. You can go through our online trading courses on IG Academy to learn more about technical analysis and chart patterns. Alternatively, head over to our dedicated forum, IG Community – ABCD pattern to discover how other fellow traders have fared using the trading strategy.

ABCD bull flag and bear flag strategy

From the last point the price dropped below the A level, made a rounding bottom, and changed direction. A bearish ABCD pattern appeared in the daily chart of gold from mid-July to mid-October of 2015. Your take-profit should be at least from the C to the A level or adjust as new formations appear. Finally, based on smaller patterns and confirmation place your trade.

Knowing that the AB leg should be the same length as the CD leg, an investor can use this tool to pinpoint where the new lows and highs will fall and invest accordingly. In the contemporary marketplace, chart patterns are a favorite tool for legions of participants. In the study of Japanese candlestick or open-high-low-close pricing charts, patterns are often used to evaluate market state or to craft trading decisions.

The https://en.forexbrokerslist.site/ develops when the line AB is equal to the line CD. The lines AB and CD are known as legs, while the line BC is called correction or retracement. If you want to trade ABCD patterns, as well as many other profitable patterns, live with our team, join us in the Investors Underground chat room. Live streams Tune into daily live streams with expert traders and transform your trading skills. Since equal AB and CD distances are one characteristic feature of the pattern, a trader may enter a buy trade, thinking that point D has been located. However, the price may fall substantially lower if the actual ABCD pattern forming is characterized by the C to D distance being approximate 161.% longer than the A to B distance.

You should also avoid trading during the pullback because you don't know the bottom of this pullback. You should do what everyone is doing since a trend is your buddy. Biotech stocks are stocks in medical device and drug development companies. Use StocksToTrade’s ‘Top Percent Gainers’ scan in the morning.

Please ensure you understand how this product works and whether you can afford to take the high risk of losing money. Bearish ABCD patternTo take positions, traders wait for the pattern to complete, then go long or short at point D. In the bullish version, traders buy at D, while in the bearish version, traders sell at D. However, a conservative trader may take positions after point D. The ABCD pattern is a fairly simple harmonic pattern based on Fibonacci ratios. Trading on it is relevant for different financial markets.

An aggressive trader may buy after the completion of the bullish engulfing. And a conservative trade may wait longer for the price to cross the resistance line of the pattern and wait for a confirmation. Then, when you are sure this pattern exists, look for confirmations such as technical indicators and chart structures.

Notice that in this example, the ABCD extension from C to D occurs in 16 bars vs the 10 bars for the AB. That gives us a nice 161.8% compared to the first leg . While this isn't an exact science, we recommend that you look through the trading simulator for different examples of abcd patterns and measure them to find your best fit. Conversely, in a downtrend, sellers are in control the entire way from A to D. However, like the long example, the idea is that once sellers have a "three-wave" move down, it will likely result in a near-term reversal pattern at D.

As a general rule, a directional market is in the midst of a trend. You can trade with the ABCD pattern by looking for bullish or bearish reversals. You should enter your trade when the market is in your favor and exit when the market moves against you.

This is because the pattern can help you identify key levels where the market is likely to reverse. By knowing these levels, you can exit your trade before the market turns against you. We recommend using these levels together with support and resistance you identify at the chart using various tools of technical analysis.